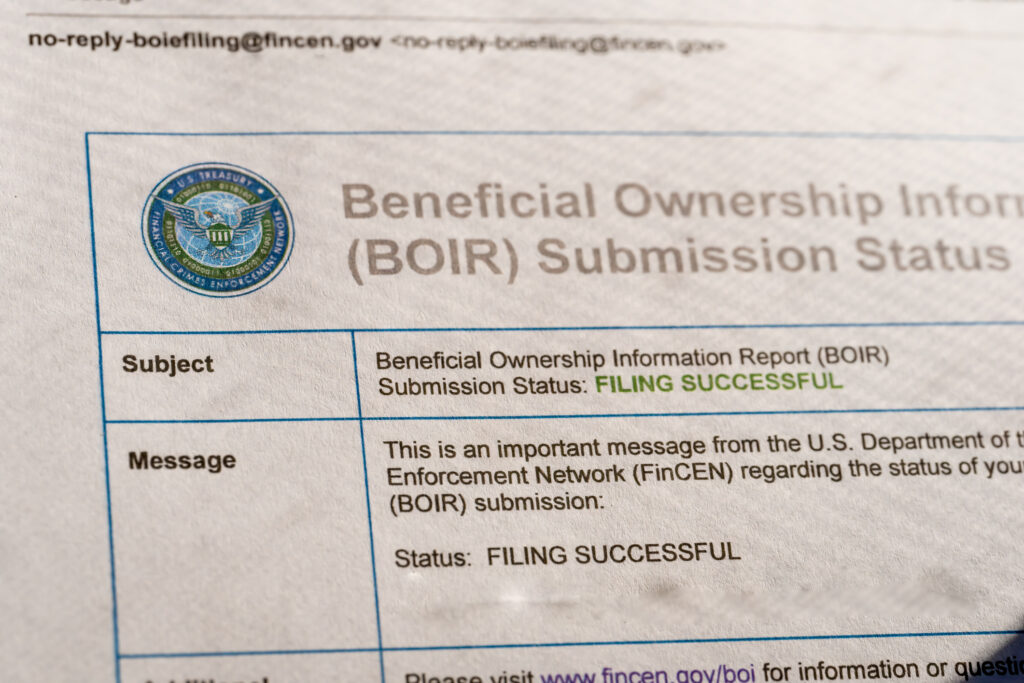

The Corporate Transparency Act (CTA) was enacted in 2021 to prevent individuals or organizations from using shell companies to obscure illegal activities such as money laundering. Under the CTA, most corporations and limited liability companies (LLCs) must report information about the individuals who have significant ownership or control of those entities. The Financial Crimes Enforcement Network (FinCEN) collects reports to increase transparency in corporate dealings.

Numerous business groups challenged the CTA, claiming it places undue burdens on small organizations and raises privacy concerns. Critics point out that complying with the reporting requirements can be time-consuming and expensive, and smaller organizations may not have the resources to fulfill them. Additionally, reporting could violate an individual’s rights to privacy and create security risks if the data were misused.

On December 3, 2024, a Federal District Court issued a temporary injunction against the CTA’s reporting mandates, effectively pausing enforcement until legal questions are resolved. The court found substantial constitutional issues, including possible infringements on privacy rights.

As of February 27, 2025, the U.S. Treasury Department announced it will not enforce the CTA against American companies that fail to disclose beneficial ownership information. This pause is presented as part of the Trump administration’s effort to ease regulations on small businesses. Prior to that date, FinCEN had extended the deadline for the CTA filing to March 21, 2025. Now, the Treasury plans to narrow the law’s scope primarily to foreign reporting companies, rather than domestic ones, and will issue an interim rule clarifying these changes before March 21, 2025.